(Schiff)—Russia and the Saudis are driving up oil and diesel prices. But these moves are likely to undermine the rouble more than they undermine the dollar, euro, and other major currencies. Therefore, higher energy prices will rebound on the Russians this winter: if they shiver in Germany, they will freeze in Russia. If the dollar is king of the fiats, the rouble is just a lowly serf.

There is little doubt that Putin and his advisers are aware of this problem. Plan A was to introduce a new gold-backed BRICS currency which might be expected to weaken the dollar and euro relative to the rouble. Plan B was more drastic: to back the rouble itself with gold. This is the financial equivalent of dropping a hydrogen bomb on the dollar and the global fiat currency system upon which it is based.

As well as demonstrating why there is no option for Russia but to back her currency with gold, this article shows why it is perfectly possible for Russia to do so during wartime and explains how it can be done. It is, as a matter of fact, very easy for Russia to reintroduce a gold standard for the rouble, but the consequences for the global fiat currency system are nothing short of lethal.

Introduction

For the last decade I have argued that there is a strong financial element in the wars between the Asian hegemons and America. President Trump’s trade policy towards China and his banning of Chinese technology, notably of Huawei, the world leader in G5 mobile technology was not just to suppress competition to America’s technology leadership but also to discourage global capital flows into China, which otherwise might have gone to America. And Ukraine gave President Biden the excuse to cut Russia out of global currency markets.

All had gone quiet, superficially at least, until Russia declared its special operation against Ukraine, setting in motion a sequence of events which rebounded badly on the West. Initially, the rouble soared in value when Putin responded to western energy sanctions by setting his own payment terms. But since then, the rouble has declined and it has become clear that as a fiat currency the rouble will continue to weaken against the dollar. The weakening rouble is the principal chink in Putin’s armour.

In response to sanctions, Putin appointed one of his advisers, Sergei Glazyev, to design a trade settlement currency, initially for the Eurasian Economic Union. It is believed that the scope was widened into a planned BRICS gold denominated currency, confirmed by the Russians ahead of the BRICS summit last month. But for China and India that was a step too far too quickly. China’s yuan is a component in the IMF’s SDR, a hard-won privilege which might have been threatened if it backed gold as a trade settlement medium. India has a history of anti-gold Keynesian monetary policies and is keen to develop trade links with the US and its allies, as demonstrated by its hosting of the G20 meeting last weekend and its prospective free trade agreement with the UK. China may have also been concerned that the consequences might be destabilising for the global currency system.

The hesitancy of the two most populous nations on earth over the gold issue is now creating significant problems for them, as the chart below of their respective currencies shows.

I have inverted the y-axis on both charts to make the point that the current rally in the dollar’s trade weighted index may not mean very much for the euro, which is its largest component, but it is undermining the major Asian currencies badly. When, rather than if the rupee breaks below its current support level, a move to test the INR100 level looks all but certain. And despite zero consumer price inflation in China, the yuan has already broken support and looks like falling even further. No wonder China’s citizens are pushing gold prices up to significant premiums: it is their escape from a falling currency. The Indians have yet to get used to higher gold prices in rupees, but that is likely to be only a matter of time.

A particular currency target is Russia’s rouble, illustrated in our next chart.

In an attempt to stop the slide, Russia’s central bank raised its interest rate by 3.5% to 12% in August, which initially rallied the rouble, but it is now sinking back towards its recent low against the dollar. But while Putin and his economic advisor Maxim Oreshkin appear to have a reasonable grasp of monetary affairs, the same cannot be said of the leadership of Russia’s central bank. At the time of the interest rate hike, Oreshkin wrote that “a recent acceleration of inflation and the sinking currency were the result of loose monetary policy, and that the central bank “has all the necessary tools to normalise the situation”.[i]

The issue is that the central bank has followed expansive fiat monetary policies by allowing M0 money supply to expand by 26% in the year to August. Directly addressing this expansion of central bank credit would have done more to stabilise the rouble than crippling interest rate increases. While much of the destabilisation of the rouble can be attributed to the continuing expense of the war, there can be little doubt that it is also partly due to the dollar’s recent strength. As is the case between the dollar and most other fiat currencies, there is a relative trust factor working against the rouble. Irrespective of interest rate differentials, it is the fact that fiat currency values are tied to nothing more than the faith in them. And Russia now faces the problem that in a fiat currency regime run in western capital markets it can never match the faith and credit in the US dollar. In current currency conditions, the dollar can always undermine the rouble because the US controls the fiat currency agenda.

The weakness of the rouble is perhaps the only real pressure point that America and NATO can apply. The war in Ukraine is turning out to be yet another NATO debacle, which only appears not to be the failure it is due to the western alliance’s control of its media-reporting. In a world driven by propaganda, we cannot know the truth. But any military commander who thinks, as did Napoleon and Hitler, that a land-borne army can defeat the Russians in Eastern Europe is deluding himself. While grinding down the Ukrainian army, the Russians are digging in for the long haul, expecting growing dissent in the NATO membership to undermine its unity. It is a plan which appears to be working.

The energy war could backfire badly against the rouble

Dissent in NATO can be expected to increase this winter, as energy shortages begin to bite. The most recent salvo in the energy war is timed ahead of the northern hemisphere winter. Russia and Saudi Arabia have jointly been squeezing oil supplies, pushing crude prices above the G7’s price caps. One area where energy supplies will hurt the Europeans more immediately is heating oil, which is also regarded as the proxy for diesel prices having increased in dollars by nearly 50% in the last quarter alone.

The importance of diesel is that logistics in Europe (and America) are almost entirely dependent upon it. On top of earlier OPEC+ cuts of 2 million barrels per day, the more recent 1.3 million barrels per day cuts in oil output by Russia and Saudi Arabia are bringing pressure to bear on the supply of distillates (of which diesel is one) and Russia also plans to cut its diesel exports by a quarter, partly due to refinery maintenance (allegedly) and partly to divert supplies to its domestic economy. While the EU’s gas reserves are relatively full at 90% of capacity, it is not nearly enough to see the EU through the winter. From December onwards, there will be a scramble for more supplies. And the end of the agreement on Black Sea grain exports will put further pressure on food prices as well.

Therefore, the western alliance will face further inflationary pressures, likely to give higher interest rates and bond yields a new impetus. Already, there is a credit crisis developing in key western economies, with banks trying to reduce their risk exposure to financial and non-financial markets in the face of a recession. And as the credit crunch intensifies, the likelihood of a new round of bank failures increases.

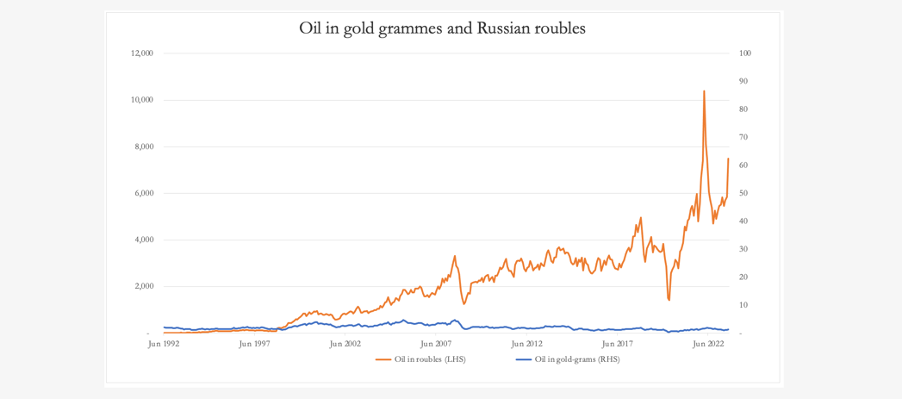

The problem for Russia is that in pursuing energy policies with the intention of undermining the dollar and euro, the consequences for the rouble are likely to be far worse. The next chart, of oil priced in gold and roubles, illustrates the point.

The first point to note is that in 1998, the rouble was redenominated at a ratio of 1000:1. Back-dated by this factor, in June 1992 there were US$7.25 to the new rouble, and a barrel of oil was valued at 2.03 gold-grammes. Today there are nearly 100 roubles to the dollar, and a barrel of oil is over RUB 7,500. As a fiat currency, the rouble has behaved like a third-world currency relative to the dollar, let alone gold. And the domestic price of oil in Russia has soared along with the rouble’s collapse. Furthermore, the exceptional volatility in the rouble price of oil is extremely disruptive for the domestic economy, with heating becoming unaffordable for Russia’s citizens in desperately cold winters.

To quantify this distress, between September last and end-July, priced in roubles the oil price increased from RUB4,707 per barrel to RUB7,500: that is an increase of 59%. In dollars, the price rose from $78.72 to 81.72, up less than 4%. Clearly, the energy battle cannot be won by Putin, because if they shiver in Germany they will freeze in Russia.

Coffee the Christian way: Promised Grounds

The chart above puts Putin’s energy war in its proper context. Withholding energy from western markets will undoubtedly destabilise their currencies. But the blowback on the rouble will be even worse. But Russia’s analysts, including Maxim Oreshkin and Sergei Glazyev (who has already recommended a gold standard for the rouble) must surely know this. And the chart also tells us that priced in gold oil is considerably more stable. In June 1992 a barrel of oil was 2.03 grammes, today it is 1.41 grammes, a fall of 30%. Bearing in mind that gold is real money, and currencies are highly unstable credit, Russia is getting 30% less for her oil today than she did in 1992.

Again, in common with the Saudis, the Russians are aware that American monetary policy has had the consequence of undermining the true value of their oil, something they have been powerless to correct without binding the price of oil to gold. There can be little doubt that Russia’s motivation to take control of energy values was behind its proposal for a new BRICS gold backed currency and that it was part of a two-step plan.

The first step was to send a signal to markets that the era of the fiat dollar was over, justifying the second step which was for Russia and China, followed by other nations in the BRICS camp to evolve their own currencies onto gold standards as a protective response to a declining dollar. But China was not going to take the offensive against the dollar, and the Keynesian Indians were not convinced.

Russia will take the BRICS presidency next year, so we can assume that the new BRICS currency has not gone away. Meanwhile, if Russia is to use the oil weapon against the West, then it must put the rouble onto a gold standard again as a matter of urgency (it was on a gold standard until Khrushchev devalued the rouble in 1961). If Russia prevaricates on this issue, then Putin’s legacy to be a latter-day Peter the Great will be destroyed by his own currency.

The practicalities of a Russian gold standard

In the middle of a war, usually a government suspends its gold standard. This would suggest that Russia can only consider a gold standard after its special operation in Ukraine is over. But the modern equivalent of a gold standard, the currency board, has been successfully established in modern times in nations with far worse budget deficits than Russia. Russia was in the fortunate position of a budget deficit of only 2.3% of GDP last year, despite military spending. This year, military spending has soared, and at a guess the deficit will be about 5% of GDP this year, but government debt to GDP will still be about 20%.

Anything other than ball-park numbers for the Russian economy are difficult to come by, and the volatility of the rouble is a further analytical hazard. But some of these numbers are not substantially different from where Britain was economically in 1816, when a return to the gold standard was planned — the exception being her estimated debt to GDP number, which at nearly 200% was ten times that of Russia today. Therefore, there is no reason why Russia cannot put the rouble onto a gold standard immediately.

In doing so, the objective is simple: to ensure that the purchasing power of circulating credit retains its value in terms of goods and services with as little fluctuation as possible. It would allow savers to accumulate credit balances in their bank accounts, and for businessmen to calculate the profitability of their investments with greater certainty. With income tax currently at a flat 13% rate and corporation tax at 20%, in these conditions economic progress will advance surprisingly rapidly. And there is every reason to expect Russia would quickly become an economic counterweight to the sheer power of China, rather than living off the depletion of her natural resources. It is necessary not just for Russia to distance herself from the fate of the western fiat currency system, but also for President Putin’s legacy.

The method of ensuring monetary stability is equally simple: to bind credit denominated in roubles to gold, which both in law and naturally is the money of the people. It is the highest form of credit, there being no counterparty risk. It’s purchasing power in the general sense has held steady through millennia. Importantly, it removes the currency from political control and dollar influences. It allows for the creation and destruction of credit determined solely by the needs of the Russian people, both as businessmen and consumers.

In constructing a new gold standard for Russia, we can learn from the lessons of the past, particularly the establishment of Britain’s gold sovereign coin fixed at 113 grains (7.99 grammes) to a one pound Bank of England banknote, freely exchangeable at the holder’s option. There were mistakes made in the implementation of Britain’s gold standard in the nearly one hundred years of its existence, but in the light of experience we should know how to avoid them today.

The principal errors incorporated in the 1844 Bank Charter Act were to not realise that redemptions of bank notes for sovereign coin were inconsequential. The occasional runs on the Bank of England’s gold reserves always originated in cheques drawn on the Bank for bullion. Amazingly, this source of encashment was not foreseen by the framers of the Act, leading to crises in 1847, 1857, and 1866. The Act was suspended on these three occasions, the crises were averted, and the Act subsequently reinstated every time.

The observant reader will have noted that these runs on the Bank’s bullion reserves fit in with an approximate ten-year cycle of bank credit expansion and crisis, a cycle still evident to this day. The 1847 suspension came about after the Bank had made immense advances to commercial banks to rescue them from insolvency. But the Bank’s advances were insufficient to stop the crisis. With Parliament staring into an economic abyss, it authorised the bank to issue notes at discretion, and the panic immediately subsided.

Ten years later in November 1857, the Bank’s monetary assets were comprised of gold and silver, which together with its own notes bought in had declined to only £387,144 compared with liabilities to commercial banks of £5,458,000. It was on the point of having to cease trading within the terms of the act. Consequently, the government authorised the Bank to expand its liabilities at its discretion, but at a discount rate of not less than 10%. The following day, the panic passed.

In 1866, the prominent discount house, Overend Gurney failed. Again, the government authorised the suspension of the Act, allowing the Bank of England to expand its liabilities to deal with the crisis, but again at a punitive discount rate of not less than 10%. As before, the run on the Bank of England’s gold reserves ceased.

In all three cases, the suspension of the 1844 Act saved the nation from untold economic damage. In this respect, the Act was a failure. Insisting on the restrictions of the Act come hell or high water and simply letting banks and businesses fail is never an option. Therefore, a successful gold standard must allow for the management and containment of banking crises, the inevitable consequence of periodic over-expansions of credit. There has to be the flexibility to support otherwise solvent commercial banks in times of crisis. In all three cases above, it was the function of the banking department to avert the crisis by extending additional credit. It should not have been the function of the issue department to get involved, and if the separation between the two had been different in its detail, the Act need not necessarily have had to be suspended.

I should mention a further error in the framing of the 1844 Act. At that time, it had been assumed that a drain on the nation’s bullion would only occur if the balance of trade with other nations was unfavourable, because settlements would be conducted in gold. While this was obviously true, there was a far greater influence on bullion flows: differences in discount rates (or interest rates in modern terminology) between centres with currencies on gold standards.

If the interest rate in Centre A exceeds that in Centre B by more than the cost of transporting bullion between them, then bullion will flow from Centre B to Centre A. This is why the setting of interest rates must be solely to regulate bullion flows. To explain further why this is the case, it should be understood that the future value of gold includes the interest accumulated with it, being payable in gold. Therefore, if the sum of principal plus interest is less in one place than another, gold will naturally gravitate from the former towards the latter.

Armed with this knowledge, Russia can easily establish the rouble on a gold standard and maintain it. In light of the foregoing, the following are the basic principles required to achieve this goal.

- The objective is to ensure that rouble banknotes and balances held in the Issue Department (see below) are freely encashable into gold coin and bullion.

- The issue and redemption activities of rouble banknotes must be transferred from the Central Bank of Russia to a new entity charged solely with managing the note issue, which we will refer to as the Issue Department. The central bank’s gold reserves must also be transferred to the Issue Department. Furthermore, the Issue Department must have the sole power to set interest rates with the mandate of maintaining sufficient bullion balances at all times. By these means, interest rates will no longer be a matter for monetary policy, being handed down to the markets.

- The Banking Department will continue with its other functions on behalf of the Russian state, except for the setting of interest rates. It will act as it sees fit in the management of commercial bank failures, extending credit or withdrawing it when necessary to maintain stability in the overall credit system.

- The separation between the Banking and Issue Departments must be defined and confirmed in law. As separate entities, each shall have its own balance sheets, so that the credit activities of one are separate from the other.

- Along with the power to set interest rates, the Issue Department will be empowered to maintain reserve balances (the counterpart of bullion submitted to it) paying interest at a small discount to the official rate. Assets on the Issue Department’s balance sheet balancing these reserves will be held as interest paying deposits at the Banking Department, allowing the Issue Department to generate sufficient profit between its liabilities and assets to cover its costs and the costs of minting coin.

- Any restrictions and taxes on gold coin and bullion must be removed by law. All foreign currency restrictions and controls must be removed as well to permit the free flow of bullion.

Currently, Russia’s official gold reserves are declared to be 2,301 tonnes. It is thought that between two state funds, the Gokhran (State Fund for Precious Metals) and Russia’s National Wealth Fund, Russia has a further 7,000—9,000 tonnes. Their holdings need not be folded into the Issue Department (though it may be advantageous to the funds to do so), but public declaration of their quantity would be helpful to establish the gold standard’s initial credibility.

The rouble must be defined by weight in gold grammes and be fully exchangeable in gold coin. New coin must be minted accordingly, perhaps with a face value of 50,000 roubles and exchangeable in those units (currently the equivalent of about $500, and similar to the value of a British sovereign). The time taken to design and mint the new coin will delay its introduction, but there is no reason why a bullion exchange facility cannot start immediately.

This is how it will work.

The bullion exchange facility operates not through the Banking Department, but through the Issue Department. In order for a commercial bank to have a credit balance with the Issue Department, bullion must be deposited in the first place. And it is here that the lessons learned from the 1844 Bank Charter Act comes into play.

Banks eligible to open an account at the Issue Department can buy gold in domestic and foreign markets, where the lease rate for 12 months is currently less than 2%. We can take that as an indicated rate of interest that global markets pay to borrow gold. Therefore, in one year a holder of 100 ounces of gold has 102 ounces equivalent (assuming the interest accumulates in line with the gold price and is paid in gold — which is not the case). Meanwhile, the Bank of Russia’s key rate is 12%. The uplift in return for a buyer of gold in international markets depositing gold with the Issue Department is 10% accumulating in gold.

It now becomes obvious that Russian and other banks accessing the Issue Department will provide the gold deposits to ensure that the Issue Department will rapidly accumulate all the bullion it needs to operate a secure gold standard. And it is equally clear that with the ability to regulate the interest rate, the issue Department can manage its gold reserves.

In its initial stages, credibility is obviously key. This can be rapidly achieved by the Russian banks supporting the plan, which they are bound to. Any bank on Russia’s SPFS payments messaging system can open an account with the Issue Department. This should be extended to any licenced bank in the Shanghai Cooperation Organisation and BRICS with secure messaging system access to the Issue Department. As well as acting as principals, these banks can operate on behalf of their customers. Russian oligarchs and draft-dodgers who have sold their roubles would almost certainly rush to buy them back, and even deposit gold with the Issue Department through the agency of their banks.

Coffee the Christian way: Promised Grounds

On current interest rate spreads, bullion inflows should be substantial: arbitrage with western bullion markets will ensure it. Given current sanctions against Russia, London and other markets under the control of the western alliance will not be directly available to sanctioned banks, a factor which is likely to provide a significant boost to gold trade in Asian and Middle Eastern markets. Sanctions will not stop gold shipments. Nonetheless, Russia’s success is bound to lead to imitators, almost certainly the Saudis, and if not immediately the Chinese are bound to follow.

A rouble priced in gold will also make energy payments in declining fiat currencies even less desirable to Russia, which will have to be sold — for what? The divide between the fiat world and gold standard currencies is going to become a very wide gulf indeed. A new impetus for the delayed BRICS trade settlement currency is bound to ensue, particularly with Russia taking the BRICS chair in January. India’s hope that payment terms for oil will be set by nations on fiat currency standards should be dismissed.

For the other BRICS currencies, a currency board relationship with a gold backed currency becomes a live option. The more natural alternative to the rouble (which Russia may not desire anyway) is to tie in with China’s renminbi — if or when it adopts a gold standard. China may not be far behind Russia in implementing its own gold standard anyway, because the consequences for the dollar and euro could be sufficiently undermining for China to seek to protect her own currency.

The impact on the dollar of the move to gold standards

Chalk and cheese, oil and water, diamonds and dust: whatever metaphor you care to choose, it must be clear that a mixture of gold standards and fiat currencies will not last long. Priced in fiat currencies, gold’s value might be expected to rise significantly, as central banks in what is now termed The Global South (the Asian hegemons and those aligned with them) move towards replacing fiat currencies in their reserves with gold.

Don’t just survive — THRIVE! Whole Cows has launched offering freeze-dried beef for long-term storage. Don’t wait for food shortages to get worse. Stock up today. Use promo code “veterans25” at checkout for 25% off!

According to Ambrose Evens-Pritchard (Wednesday’s Daily Telegraph), “The Global South holds three-quarters of the world’s $12 trillion of foreign exchange reserves (59 per cent held in dollars)”. And in addition to a $2-plus budget deficit, in the next year the US Government has to refinance about 30% of its existing debt.

Therefore, the impact of a move to gold on funding the western alliance’s deficits will be substantial, because not only will The Global South stop buying their bonds, but they will seek to liquidate their existing holdings. In the absence of severe spending cuts and increased taxes, increasing monetisation of government debt will become inevitable. Kiss goodbye to lower inflation, lower interest rates, and lower bond yields: embrace crashing bond prices and collapsing asset values. What over-leveraged bank can survive the squeeze on their balance sheets? Which of the western alliance’s central banks, already deeply into negative equity will be able to monetise their government’s debt with further QE against a background of soaring bond yields?

Inflation of energy prices, already low measured in gold grammes, is bound to increase measured in collapsing fiat. Truly, if Russia does introduce a gold standard for the rouble, it will be the financial and economic equivalent of a nuclear attack on the entire fiat currency system. There can be little doubt that these consequences for the global financial system are what have made Russia hesitate so far. China is sure to have arrived at a similar conclusion, one reason why she was too cautious to support Russia’s proposal for a gold backed trade settlement medium. But Russia is reaching a point where she has no other way to stabilise her currency.

Russia and NATO (by which we really mean America) have got themselves into positions from which they cannot back down. Unless Russia stabilises her currency, her likely victory in Ukraine will be pyrrhic. Putin’s policy of driving up energy prices will have worse consequences for the Russian people this winter than for Europeans and Americans, because of a collapsing rouble. And a collapsing rouble will also drive up food prices, a combination which will almost certainly destroy Putin’s government.

- Preserve your retirement with physical precious metals. Receive your free gold guide from Genesis Precious Metals to learn how.

Whichever way you look at it, it is the currency factor which matters above all else and the Russians have no option but to stabilise the rouble by defining it in gold grammes and making it immediately exchangeable on the lines described in this article.

It will be a tragic end to the dollar-based fiat currency regime.

Independent Journalism Is Dying

Ever since President Trump’s miraculous victory, we’ve heard an incessant drumbeat about how legacy media is dying. This is true. The people have awakened to the reality that they’re being lied to by the self-proclaimed “Arbiters of Truth” for the sake of political expediency, corporate self-protection, and globalist ambitions.

But even as independent journalism rises to fill the void left by legacy media, there is still a huge challenge. Those at the top of independent media like Joe Rogan, Dan Bongino, and Tucker Carlson are thriving and rightly so. They have earned their audience and the financial rewards that come from it. They’ve taken risks and worked hard to get to where they are.

For “the rest of us,” legacy media and their proxies are making it exceptionally difficult to survive, let alone thrive. They still have a stranglehold over the “fact checkers” who have a dramatic impact on readership and viewership. YouTube, Facebook, and Google still stifle us. The freer speech platforms like Rumble and 𝕏 can only reward so many of their popular content creators. For independent journalists on the outside looking in, our only recourse is to rely on affiliates and sponsors.

But even as it seems nearly impossible to make a living, there are blessings that should not be disregarded. By highlighting strong sponsors who share our America First worldview, we have been able to make lifelong connections and even a bit of revenue to help us along. This is why we enjoy symbiotic relationships with companies like MyPillow, Jase Medical, and Promised Grounds. We help them with our recommendations and they reward us with money when our audience buys from them.

The same can be said about our preparedness sponsor, Prepper All-Naturals. Their long-term storage beef has a 25-year shelf life and is made with one ingredient: All-American Beef.

Even our faith-driven precious metals sponsor helps us tremendously while also helping Americans protect their life’s savings. We are blessed to work with them.

Independent media is the future. In many ways, that future is already here. While the phrase, “the more the merrier,” does not apply to this business because there are still some bad actors in the independent media field, there are many great ones that do not get nearly enough attention. We hope to change that one content creator at a time.

Thank you and God Bless,

JD Rucker